resolution source: https://www.coingecko.com/en/coins/bitcoin

Resolves YES when bitcoin hits $1 million after market creation.

Resolves NO when bitcoin hits $100 after market creation.

There is no adjustment for inflation.

If USD is replaced by a successor currency, this market will use the successor currency and the last available exchange rate from USD to the successor currency.

If bitcoin is replaced by a successor currency, this market will use the successor currency and the last available exchange rate from BTC to the successor currency.

If USD ceases to exist without a successor, resolves YES

If bitcoin ceases to exist without a successor, resolves NO

If AI kills us all and both cease to exist at the same time, it resolves N/A.

If this market expires without any of the resolution criteria being met, it resolves N/A.

Obviously the price cannot go to $100.

$100 * 21 million bitcoin = 2.1 billion dollars

Obviously there will be more demand than that once it even gets close to that price; this is true regardless of the reasons why it was getting there (e.g. legal prohibition). It is sufficient that people will have in mind its historical value and consider that it might one day get there again.

It can't very easily get to one million either but this is far, far more possible than getting to $100.

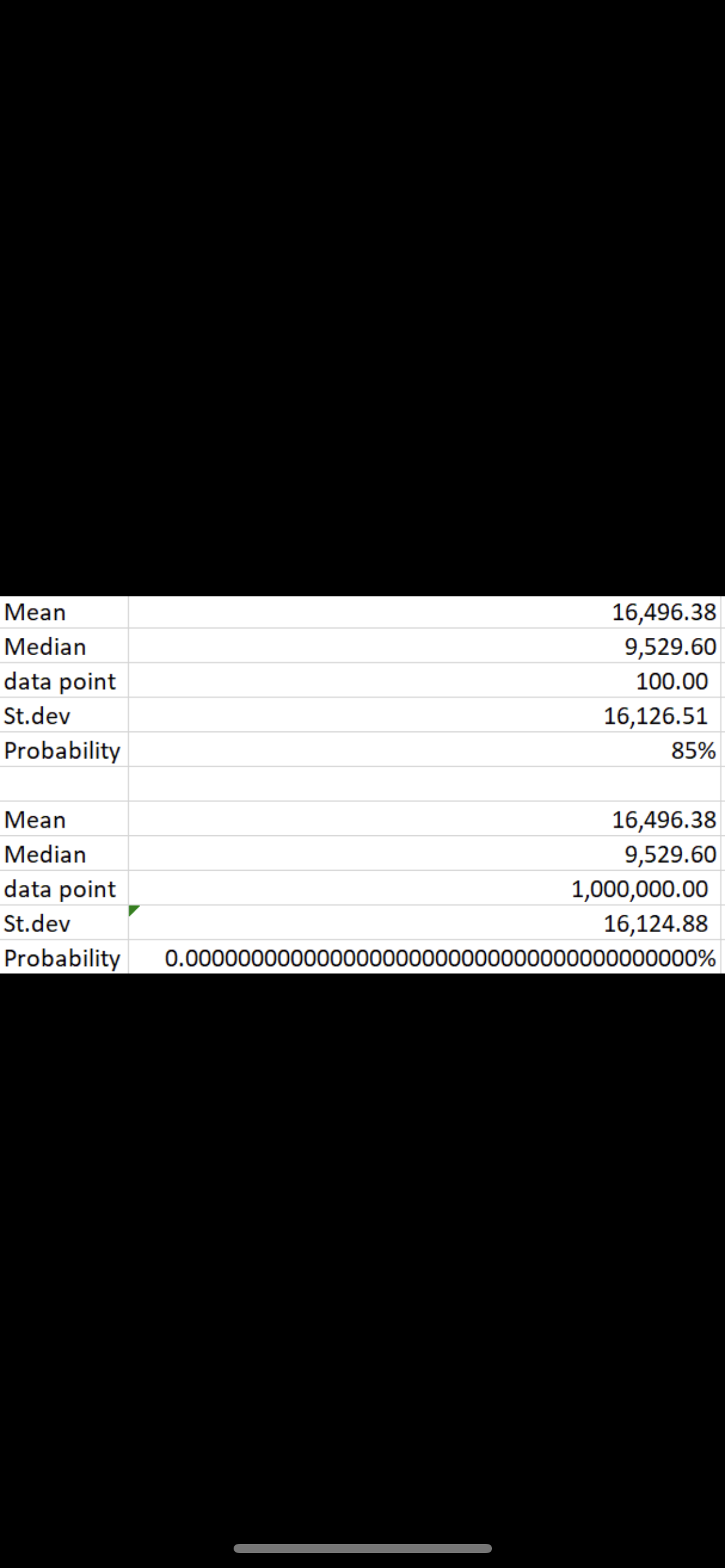

To answer this question first we need to see the historical movement of the price of Bitcoin. Having the historical data, we can calculate the mean and the standard deviation. Having this information we can put data point of 100$ as well as another data point of 1 000 000$ in order to calculate the probability for every data point that we put. Then we can calculate the probability

As You can see from the picture below, taking into account the historical closing price for every day from 2016 to 10.27.2023 the probability of the price reaching USD 100.00 is much higher (85%) than the probability the price to reach 1 000 000, which is basically 0.00.

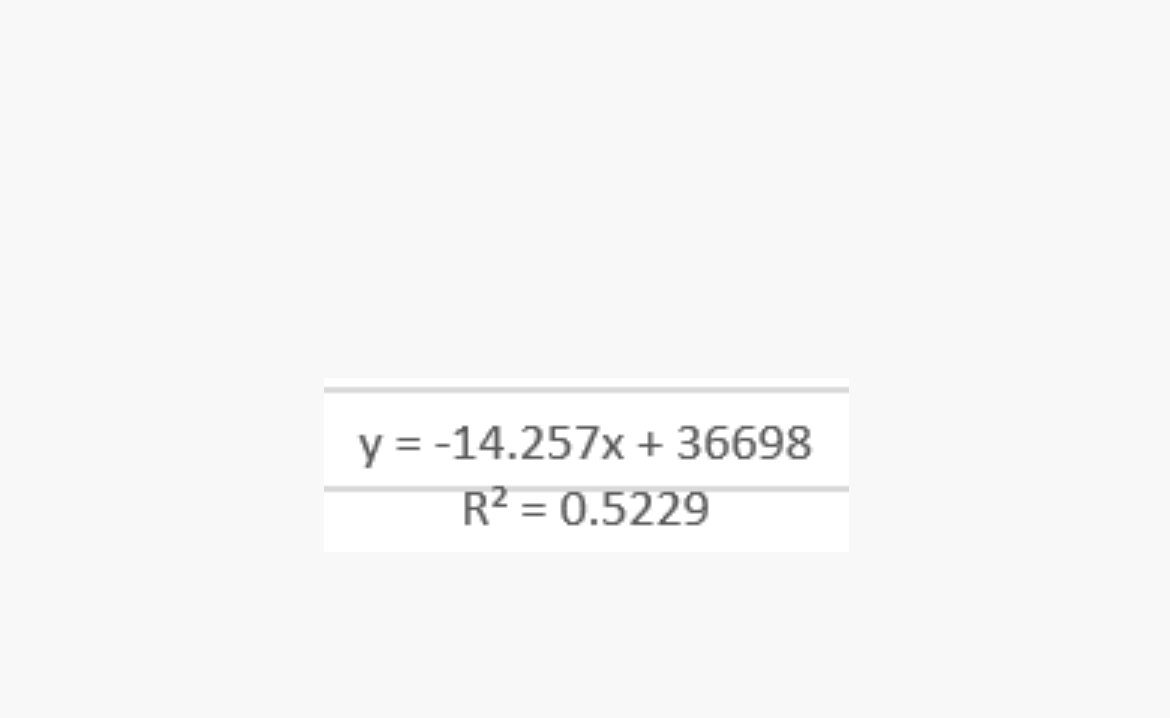

But because the question is Will bitcoin hit $1 million before it hits $100? We need to see what the correlation between time and price movement is. We can do that calculating R^2 of the data, which is

In other words, the correlation between price movement and time is around 50%. So we can conclude taking the time in to account that we have 50% possibility of the price to correlate with long period of time which is not significant percentage.

Having in mind that the probability to reach USD 1 000 000 based on the historical data from last 7 years is 0.00 and the correlation is around 50 I would place my bet to be No. Just look more probable.

@AlexanderYankov38cd you should be taking the logarithm of the prices before you calculate standard deviation and work out the probabilities. The current price is much closer to 1M than 100 on a log scale, plus the trend over time is upward drift due to inflation and gdp growth

@mistersplice That would be a 21 Quadrillion Dollar market cap. In 15 years.

My prediction is actually, that bitcoin will reach one trillion dollar by 2024. They should write an article about my expert analysis.

I just noticed that this market can't be invested in seriously. The guy who made it has placed limit orders that would require this to be one of the largest markets on the platform to go below 69% and even larger to go beyond 30%. There is a ~70k barrier at 69% and a 100k barrier at 30%. This seems like an ad for bitcoin.

@Rwin I think the market is too high, but the large limit order make it a better investment.

We can just wait that bitcoin crash another time and make +222% of profit, and get back the loan while it doesn’t happen.

@dionisos Sure but this would lock up the investment for three months. I have cashed out for now. Maybe one of my limit orders will be filled though. But it will probably take a very long time until bitcoin drops to 100$ so without the option to cash out early this is kind of a boring market.

@Rwin If you know where to invest, yes. I mostly don't know where to spend my mana, so the limit order help.

https://manifold.markets/itsTomekK/will-bitcoin-ever-go-below-10000-ag

This one could be better for investing. Way to low and it could happen anytime.

@dionisos If you think Bitcoin is going to $100 you would do much better to short it in real markets rather than to bet on Manifold about it.

Both $100 and $1 million are unlikely, but $100 is significantly more unlikely.

@DavidBolin No, I think it is much more probable that it is going to $100 than to $1 million (and it is mostly because I think there is no chance it goes to $1 million), but it could go to $100 in 10 years or in 50 years or whatever. And in the meantime it could well go to 50k or even more.

So it would be very risky to short it, it could make me lose a lot of money, even if I am right on this market.

An unbiased log-returns walk currently gives log(27k/100)/log(1m/100) = 0.61

If we assume that the long term growth rate is equal to 2% for inflation, as mentioned below, it would take something like 183 years for the BTC/USD to hit 1m in expectation.

Meanwhile bitcoin volatility on a year-over-year basis has frequently been half an order of magnitude, so the timescale to hit one of these by volatility alone is more like 25 years.

@BoltonBailey lg(27000/100)=8 and lg(1M/27000)=5.2 so if you model it as a fair coin flip doubling or halving every year, getting to the lower bound in 25 years would have a probability of 5% and getting to the upper bound in 25 years would have a probability of 20%

But I don't think the volatility is a random walk. It's mean-reverting around a mean that is based on macroeconomic fundamentals, and this mean should grow at least as fast as nominal world gdp, faster if bitcoin gains market share.

@JonathanRay Yes, I agree that it's probably not a random walk, and my above analysis is not actually one you would want to use to assess the probability if it were guaranteed that the US government and bitcoin blockchain were guaranteed to keep chugging along into infinity, so it's a bit misleading.

A better argument for NO is more like this: The volatility argument makes it seem pretty likely that this market won't resolve in the next 25 years, and so those are the timescales we have to think about. On timescales that large the big concerns are black swans, and since the Dollar has been around longer than Bitcoin, it seems likelier that Bitcoin would be affected in a severely negative way. For Bitcoin, this could be major governments banning it, or the mining gaps problem or quantum computing or something I haven't thought of. I don't know if any of those things are likelier than not to drive the price below 100, but perhaps there's still a 30% chance they will.

@JonathanRay Anyway, here's a market to try to zero in on this. It resolves YES if this market resolves YES within 25 years.

The entire world's GPD is about 100 Trillion USD. The market cap of bitcoin at a valuation of one million dollar would be between 19.37 and 21 Trillion USD. That's pretty much the entire M2 money supply in dollar https://money.howstuffworks.com/how-much-money-is-in-the-world.html.

Bitcoin will never reach a million USD. That's almost certain. The only option for a bitcoin to equal a million dollars is if the dollar crashes completely. But in that scenario we'd have to worry about much more pressing matters than this market 😃

@mistersplice I only see one image in your comment. "The Greg Foss Flowchart". All the percentages in that image are completely arbitrary. Where do the 5% asset capture come from? That's a really, really high percentage, considering that the dollar would be 1/9th. The bull and bear percentages also make no sense. (2.1M*0.1)+(0*0.9) calculates the expected value for a situation that nets you 2.1M with a chance of one in ten. These percentages are completely made up, and the 'statistical' method used is only applicable to discrete distributions (like a dice roll for example).

Most importantly, the image isn't informed by any data whatsoever besides the bitcoin market cap and the total asset value. If finanical math and investment predictions were this easy, nobody would have ever heard the word 'Quant'.

This is not math, this is an ad.

@Rwin the 2nd place I wanted a math check was your post.

You don't think bitcoin could capture 20% of the world's value?

@mistersplice ...or LESS THAN 5% of the entire world's assets?

(which was the point in the "ad" I posted)

@mistersplice did you even read his detailed and overly generous reply?

That's a really, really high percentage, considering that the dollar would be 1/9th

@Rwin Nominal world gdp is going to grow at 6% ish, and world M1 will grow at about the same rate. At that rate, bitcoin doesn’t even need to gain market share among currencies to 64x in 72 years

@deagol I don’t think that’s a high percentage at all because Bitcoin exhibits monetary properties that the dollar lacks

@mistersplice ah now I see you weren’t really looking for a math check but someone to hear your pitch. I guess you got us then, good job.